IASME has worked in partnership with the Open Banking Implementation Entity, to create an innovative new Counter-Fraud Fundamentals Certification scheme.

Fraud is the number one crime experienced in the UK according to the National Crime Agency, globally, it is a rapidly growing threat. As banks become almost entirely digitalised and shopping moves increasingly online, it is critical that banks, card issuers, retailers and insurance providers take a stand against fraud.

Now, more than ever, it is important that financial organisations can prove to their customers and supply chain that they take their responsibility to combat fraud seriously and have the most important counter fraud measures in place.

Launching today, the Counter Fraud Fundamentals Certification Scheme is aimed at a wide range of companies from the financial services sector, including banks and innovative fintechs, to other relevant sectors such as retail and insurance. The scheme is part of IASME’s ongoing efforts to improve cyber security, risk management and good governance across the UK through innovative certifications.

Dr Emma Philpott MBE, CEO of IASME says, “As new technologies are developed and global affairs change the way we live, there is always the risk of fraudsters finding new ways to scam vulnerable customers. We at IASME have developed a tool which not only allows SMEs and consumers to feel safe and secure, but also drives education and implementation of the most important counter fraud controls, that all companies in these sectors should have in place. We are delighted to be working in close partnership with the Open Banking Implementation Entity to bring a certification to the banking, financial and insurance industries to help users fight the ever-changing threat of fraud.”

Open Banking Implementation Entity ( OBIE) was established by the Competition and Markets Authority in 2016 to drive innovation and competition across financial services, by helping consumers make better use of their financial data to access a wider range of products and services. OBIE has collaborated with IASME to develop the Counter Fraud Fundamentals Certification, lending their expertise in financial technology and fraud prevention.

Bronwyn Boyle, Head of Security & Assurance at the Open Banking Implementation Entity (OBIE) says, “Fraud is, rightly, a major concern for small businesses and individual consumers looking to use technology to improve their finances and help them manage their money. This new certification is a key step towards consumers and businesses feeling at ease with emerging technologies – such as open banking – which allow them to take charge of their finances in a safe and secure way. We are delighted to be partnering with IASME to bring this scheme to businesses across the financial services sector.”

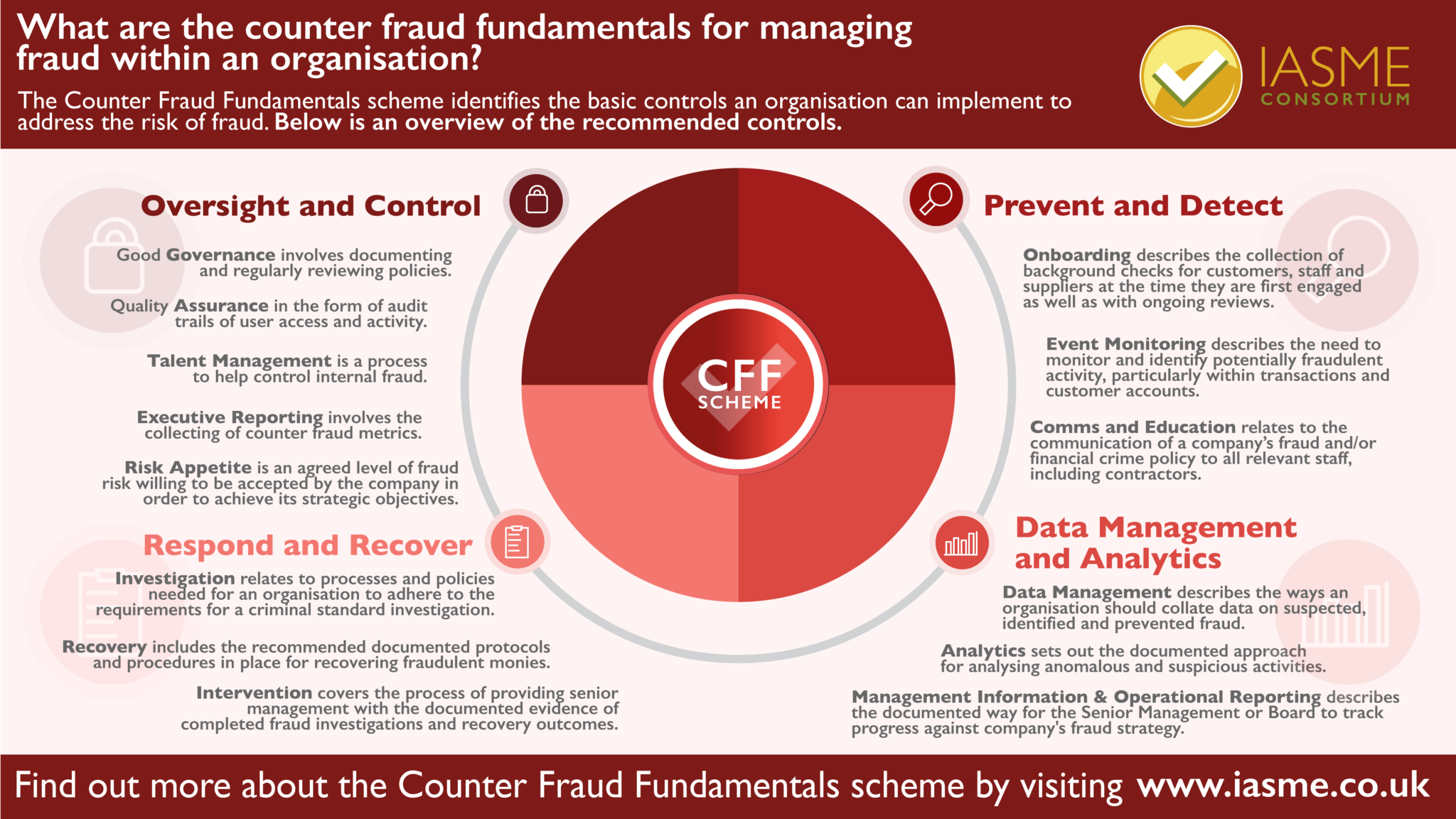

The Counter Fraud Fundamentals certification involves a self-assessment questionnaire which was collated by counter fraud experts to check and ensure that the most important elements of counter fraud are in place. The questionnaire will need to be signed off by a senior member of the board and approved by an external assessor before gaining the certification and the accompanying Counter Fraud badge. The scheme identifies the basic controls an organisation can implement to address the risk of fraud. These recommendations have a focus on oversight and control, protection and detection, response and recovery and the data management and analytics of businesses.

The Counter Fraud Fundamentals certification involves a self-assessment questionnaire which was collated by counter fraud experts to check and ensure that the most important elements of counter fraud are in place. The questionnaire will need to be signed off by a senior member of the board and approved by an external assessor before gaining the certification and the accompanying Counter Fraud badge. The scheme identifies the basic controls an organisation can implement to address the risk of fraud. These recommendations have a focus on oversight and control, protection and detection, response and recovery and the data management and analytics of businesses.

By ensuring that organisations in the finance, banking and retail sectors have the preparations in place to pass all the controls and become Counter Fraud Fundamentals certified, it is believed that the effects of fraud within the industry can be significantly reduced.

For more information about the Counter Fraud Fundamentals scheme, please contact Craig Wooldridge [email protected]